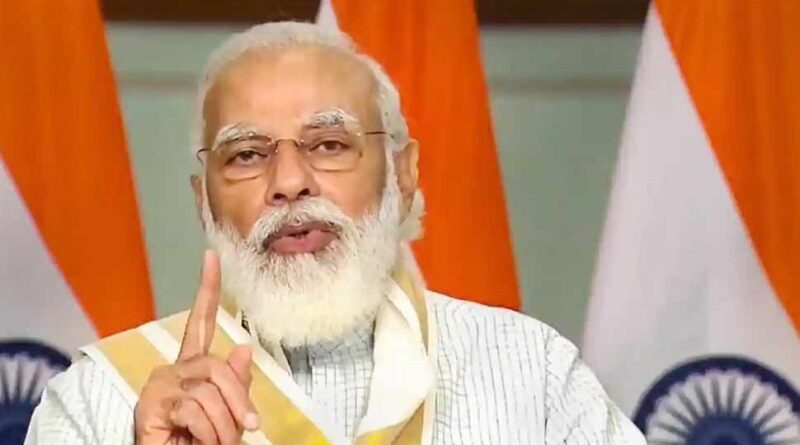

This is the new ‘tax revolution’ of PM Modi, those 5 big things to know

Prime Minister Narendra Modi (Narendra Modi) has given a big deal to the honest taxpayers of the country. He has started the ‘Transparent Taxation – Honoring the Honest’ platform today. With this new system, many facilities will be provided for the taxpayers of the country.

Prime Minister Narendra Modi (Narendra Modi) has given a big deal to the honest taxpayers of the country. He has started the ‘Transparent Taxation – Honoring the Honest’ platform today. With this new system, many facilities will be provided for the taxpayers of the country. They will get rid of the income tax department by going around, they will also get rid of unnecessary disputes. Tell you those five big things you need to know

number 1

Faceless assesmant, faceless appeal and taxpayer charter have been introduced. This means that the taxpayer will not have to go round the tax department regarding his tax assessment. If there is any complaint to the taxpayer, then he can also appeal to it without going to the office of the IT department without any fear. It will start from 25 September.

number 2

The Income Tax Department will no longer be able to hurt the reputation of the taxpayer. The Income Tax Department will now have to take care of the reputation of the taxpayer with sensitivity. Now the taxpayer will have to believe it, the department cannot see it without any doubt without any basis.

No. 3

Human intervention will be reduced in the new system and more and more technology will be used. Like which officer will see the case of which person, now it will also be decided through computer. Right now the tax department of the city where we live handles all the things related to our tax. Be it scrutiny, notice, survey or seizure, the income tax department of the same city, the income tax officer plays the main role. But in the new system, the tax officer may be from another state. No one will know in advance which officer is going to handle whose case.

Number 4

There has been a steady decline in tax scrutiny in the country. PM Modi said that out of all the tax returns used in the year 2012-13, there was scrutiny of 0.94%. In the year 2018-19, this figure has come down to 0.26%. That is, the scrutiny of the case has reduced by about 4 times. This is a big change in itself.

Number 5

PM Modi has made these big announcements to remove honest taxpayers from the atmosphere of fear and insecurity. At the same time, he has also advised those who do not collect tax. PM Modi said that in the last 6-7 years the number of those filing income tax returns has increased by about two and a half crores, but it is also true that in the country of 130 crores it is still very less. In such a large country only one and a half crore companions collect income tax. Those who are able to pay tax, but they are not in the tax net yet, they should come forward as they wish, this is my request and hope. Let us prove the resolve of new India, self-reliant India, respecting the spirit of trust, rights, obligations, platforms.